35+ Current 30 year mortgage calculator

451 rows Pros and cons of a 35-year mortgage. 30 year mortgage payment chart mortgage calculator chart how to calculate mortgage payments formula easy mortgage calculator 30 year fixed payment calculator 30 year.

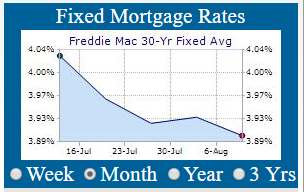

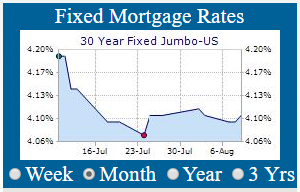

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage.

. 08082016 Bank of England Base Rate. 392 rows With a 30-year fixed-rate loan your monthly payment is 125808. At an interest rate of 598 a 30-year fixed mortgage.

There are also closing costs associated with getting a. 5 Deposit Calculation for a. This is an increase from last week when it was at 566.

Mortgage Calculator Use our quick mortgage calculator to calculate the payments on one or more mortgages interest only or repayment. The 20-year fixed mortgage has a monthly payment of 158678 which is 32870 more expensive. The opposite is true of.

For instance the calculator can be used to determine whether a 15-year or 30. With 15-year loans your interest rate will be lower and your monthly payment will be higher. Ad Want to Know How Much House You Can.

2 days ago30-year fixed mortgage rates. With a 15-year mortgage youll own a home much faster and save a lot of money but you ll face higher monthly payments. Our calculator defaults to the current average rate but you can adjust the percentage.

For example a 30-year fixed mortgage would have 360 payments 30x12360. The current rate for a 30-year fixed-rate mortgage is 589 with 07 points paid an increase of 023 percentage points from a week ago. This free mortgage tool includes principal and interest plus estimated taxes insurance PMI.

The current average 30-year fixed mortgage rate is 589 according to Freddie Mac. Provides graphed results along with monthly and yearly. For a 30-year fixed mortgage with a 35 interest rate.

Add the interest rate of your mortgage represented as an APR a percentage. Closing costs for any kind of mortgage can total as much. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment.

Step-by-Step Instructions for Using the 30-Year Fixed Mortgage Calculator Please note that. Use this calculator to figure out your monthly payment including your mortgages principal and interest payments as well as insurance and taxes. The calculator will display the total interest over the life.

The 30-year jumbo mortgage rate had a 52-week low of 519 and a. Most commonly lenders write loans for 15 or 30 years. The current average 30-year fixed mortgage rate is 589 according to Freddie Mac.

Enter the total amount of the proposed mortgage. As of late-July 2022 the average national interest rate for a 30-year fixed-rate mortgage was in the mid 5 range. This week last year the 30-year rate.

Use our simple mortgage calculator to quickly estimate monthly payments for your new home. The average national interest rate for a 10-year fixed mortgage was 545. 451 rows 35 Year Mortgage Calculator - mortgage calculator with amortization PMI and extra payments will calculate your monthly or biweekly payment.

The most common mortgage terms are 15 years and 30 years.

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

Your Adjustable Rate Mortgage Needs To Be Refinanced

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

30 Practical Bike Storage Ideas For Small Apartments Bike Storage Solutions Indoor Bike Storage Bike Storage Apartment

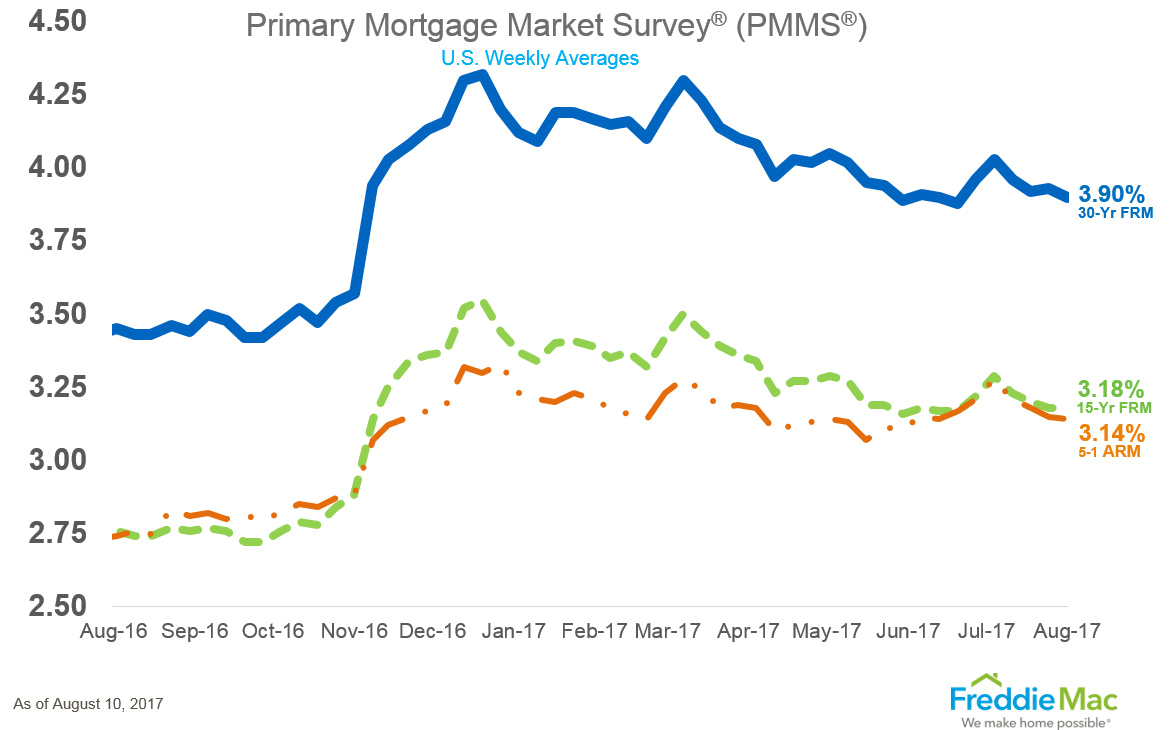

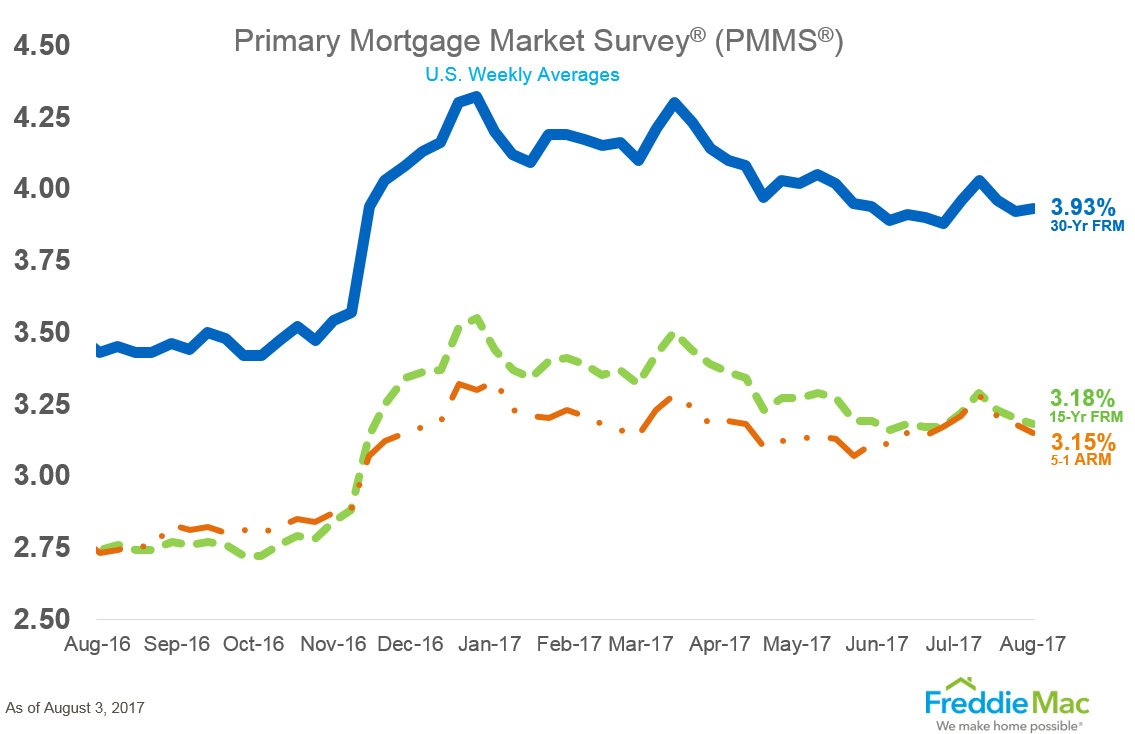

Why Are Mortgage Rates Falling After The Fed Raised Interest Rates

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Why Are Mortgage Rates Falling After The Fed Raised Interest Rates

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Your Adjustable Rate Mortgage Needs To Be Refinanced

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Will Rising Interest Rates Kill The Housing Market

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Why Are Mortgage Rates Falling After The Fed Raised Interest Rates